Every customer of referral marketing sites would worry about the possibility of being a victim of referral abuse, misuse, and even fraud. So the best thing to do is to teach them how to prevent, spot, and respond to it. What we want to do is avoid all of these while still being able to provide a positive referral experience to legit customers.

But first of all, what is considered a referral marketing abuse, misuse, and fraud? Here are some examples to make it clearer for you:

- A person receiving referral benefits without ever being your customer, without being referred by any of your other existing customer.

- Your customers that receive referral bonuses for referring themselves.

- A person who purchases but returns it or a person who opens an account the close it once they receive a referral rewards.

- Employees who earn rewards for referring new customers if employer has not approved of such activity.

How do we prevent Fraud

How do you fight back referral program scams? As a lot have experienced, there isn’t really a way to prevent them completely. But there are some ways that you could do to fight it, and that starts with preventing it and detecting it.

Built-in mechanisms should be available to prevent them from happening, and if you decide to do it proactively there are some things listed below that could help you.

1. Verify your customers

A lot of sites encounter a lot of scams because of how easy it is to create an account. If you plan to have only real existing people on your referral program then you should find a method to make sure only existing people could qualify to be part of your program. Account numbers, Mobile numbers, Combination of particular information; Family name, Given name, and date of birth.

You can do this process manually or automatically, whether daily or real time. What you want to do here is create rules wherein whenever the information being input doesn’t match, it will be denied. But this wouldn’t work for programs that allows anyone to join, so skip this and let’s go to number two.

2. Intervening manually

Let’s go to a bit higher level, have authorized program administrators to decide whether a referral should be approved, and whether a reward should be given. And this administrator should check and make sure a referrer and the person being referred are eligible for the reward because the referrer is a real existing customer, and the referred did the steps correctly. This method works exemplary when used as soon as the project launch, it brings you the capability of screening those who join your program, and preventing fraud, misuse, scam from the very beginning.

3. Rules for referrals

Let’s add more to account verifying, there are more things that could be checked against before you approve or deny a referral. You only want those who are eligible to be able to receive rewards, so here are some other things you could consider:

- A referral could be denied whenever both the referred and referrer have the same parent account number.

- A referral could be denied when both referrer and referred have the same shipping address.

- A referral could be denied when a purchase is made before the referral was actually sent.

- A referral could be denied when the instructions weren’t followed properly or the purchase was incorrect.

- A referral could be denied when either isn’t an eligible customer type, like postpaid vs. prepaid, savings acct vs. Checking acct, and others more.

- A referral should be denied if the referrer wasn’t a customer unless you accept anyone in your program (which isn’t safe at all).

- A referral should be denied if the referred person is already an existing customer.

4. Limit your rewards

By limiting the amount of rewards a person can earn you are already preventing scams to happen, but aside from that there are also other reasons to limit them. For instance, some clients limit it to $599.99 to make sure they won’t have to issue W-9 Tax forms and to avoid remitting taxes for the people part of the program. Some also limit it to only $250 so referrers won’t be able to create multiple referrals but still earn.

What you’re aiming to do here is to avoid misusing your referral program while still giving people part of it good incentives.

5. A return period

One good way to keep fraudulent acts from your program is to create a delay on approving a customer to become eligible. In other words, the referred person have to be a customer for a given set of time, or should purchase at least once to be able to receive the reward, and this goes to the referrer as well. This gives you an assurance that they could be relied on and would stick around for a longer period.

This is the beginning of preventing and detecting it, they do exist but they don’t always win. Especially, when you’re ready for them.

Detecting Fraud

When you review your data and monitor them regularly to check for signs of any fraudulent behavior then you are doing fraud detection. You can display referral data visually for analysis and review to spot any signs of marketing scams. There are more ways that could be used in specific times to accurately detect any fraud movements, here are some:

1. Using Email root to check referral participants

Dummy email addresses are what most scammers use to exploit referral programs. Most of the time they use a fixed string which is then followed by numbers that progresses in a pattern, sometimes they just use a numeric email address. Use your histogram in order to check for users that actually use this pattern.

Sadly, most of the time you’d find large groups that are entirely numeric, and those are participants with email roots. When you have a lot of participants with email roots that are numerical and the strings are repeating, that could be a sign of something suspicious and should need deeper investigation.

2. Using referral volume to check for referral activity

In a histogram chart, you have the ability to see how many referrals your referrers have sent. While you should be aiming for repeat referral activity, if the numbers are high and is in a pattern that could be recognized, and is done by a single email address in a short period of time, that could be a sign of something fishy. So take a look at that and check if the activity is really genuine.

3. Check the conversion volume of your referrals

Try a histogram chart that could count how many referrer referrals were approved. It may ne suspicious if a lot of referrals has been approved in a very short time span.

4. Use the IP Address to check referrals

This is a good way to catch them early because most of the time, scammers use the same location or machine to create numerous referrals. You can check the histogram for the number of sign-ups made by an IP Address. If there’s a high number then you should look deeper into it because that could be a sign.

But don’t judge right away because it could be a proxy server, a person located in the University, office, a public computer, well there are a lot of reasons for it to be legit.

5. Check the volume of verifying referrals

Use a bar chart that could count how many referrals are being verified by a referrer at the same time.

6. Match suspicious accounts profile address with their shipping address

When a shipping address doesn’t match the address on their profile that could mean there’s something suspicious happening.

Respond to fraud

While we focused on preventing and detecting fraud earlier, sometimes we just can’t stop it from happening. Of course we can’t just let them be, right? So here’s how you should respond to it.

Investigate

With the help of what you’ve learned above, you could identify suspicious activities that could be fraudulent movements. Before you jump into conclusion, you have to investigate. There are some cases where it can seem like a scam but it isn’t, like when there are accounts with the same name, well a lot of people have the same name.

You can check pending and approved referrals, check for the dates, names and other similar details, if in a short time the same names appear then there’s a high chance for it to be a self-referral fraud.

If the names are okay and they don’t match but you still think there’s something wrong, maybe one had huge rapid success in a short time or whatever it may be you can review them further by:

Checking the IP address of both referred and referrer.

Checking the Email address of both referred and referrer.

Checking the site where the referred click the link from.

If you still are suspicious, you can check their profile’s history, and be able to see the name’s and emails of every person they referred.

Take Action

In order to make sure scammers don’t win in any way, make sure that you have an administrator to verify all the sales in order to tell whether it is legitimate or a fraud. That way, you won’t be releasing any commission without double checking first. Once the sale has been verified then it becomes added to the software.

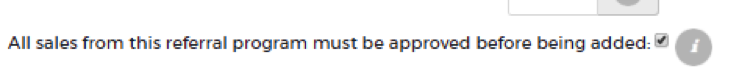

There’s a specific location where it could be temporarily reviewed before it goes to the software. With OMNISTAR, you can set this up by clicking on manage affiliate programs which could be found under setup affiliate programs on the left navigation menu. Simply click on add an affiliate program then proceed to step 2 and look for the option which says “All sales from this affiliate program must be approved before being added to the system”. Just click on this and the moment you receive a new sale, you will have to approve it before it gets added to the users invoice.

On the software, you will find an approved column where an “Approve now” link will be available. Just click on that and it will be verified right away.

Conclusion

Referral Abuse, Misuse, and Fraud is not a surprise anymore. They exist but they could be prevented and stopped. There are a lot of ways to do it, but it all starts with preventing and detecting.

ID monitoring for transactions could be implemented, IP addresses and the activity done by it could be double checked, especially if there are suspicious activities, there are a lot of security measures that could be done in order to prevent them you just have to make sure that you regularly check your referral program for anything suspicious. The best way to keep them out from your referral program is to setup that an administrator would have to approve a sale before giving out commissions and also setup that new referrers have to be approved as well. That way the administrator could double check everything, from the legitimacy and eligibility of the new referrer, the important information and also the legitimacy of the referral.

The only con here is that it could be time consuming. But when good time management is practiced, this could help your referral program a lot.

There is really no way to prevent 100% of this fraud, however you can take steps to decrease the chances of fraud.

There is always a way around security, however it is best to have someone things in place rather than nothing.

Referral Abuse is common in this industry, however I think the main way to prevent is to screen your affiliate partners before you approve them. If you notice anything shady, you can decline them.

Limiting referral volume is a good thing and bad thing. It can prevent fraud, but you can also discourage motivated affiliates.

These days most referral systems check IP address and will prevent a referred order from the same IP in a certain amount of time.